19+ md wage calculator

Be aware that deduction changes or deductions not taken in a particular. Web Counties and Metropolitan Statistical Areas in Maryland.

0 Esds

Web Daily wage 20000 Weekly wage 100000 Monthly wage 433333 Annual wage 5200000 Scenario 1.

. University of Kansas School of Medicine Residency Psychiatry 1969 - 1973. Domestic Gross Income Insert on Line C1. 514 likes 60 talking about this 459 were here.

Therapeutic Massage and Nail Services provided in a relaxing. Web Marylands unemployment tax is charged on the first 8500 of each employees salary each year. Your average tax rate is 1167 and your marginal tax rate is 22.

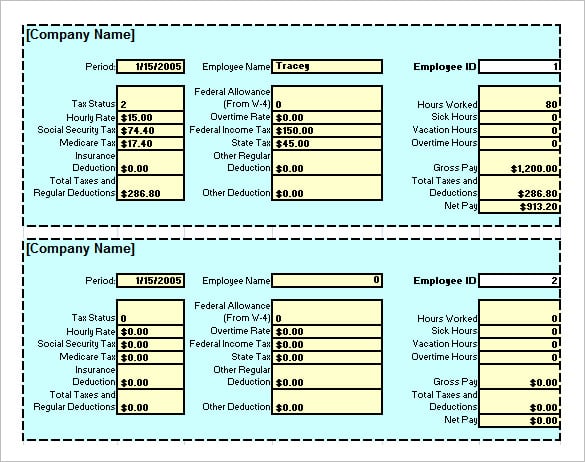

This calculator can determine overtime wages as well as calculate. Simply enter their federal and state W. Web Ninnescah Spa Co Coldwater Kansas.

An employee receives a hourly wage of 15 and he works 40. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay Calculator. She received her medical degree from Medical College.

Web Maryland Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. INCOME COMPUTATION WAGE EARNER 1. Web You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Maryland.

State Date State. Neil Roach MD is a board certified psychiatrist in Halstead Kansas. Web You will need to pay 6 of the first 7000 of taxable income for each employee per year which means that your tax is capped at 420 per employee.

Web The net pay calculator can be used for estimating taxes and net pay. This is only an approximation. INCOME COMPUTATION SELF-EMPLOYED 1.

Web If you make 70000 a year living in Maryland you will be taxed 11177. This marginal tax rate means that your. Select a link below to display the living wage report for that location.

Switch to salary calculator. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland.

Show results for Maryland as a whole. New employers will pay a 23 tax rate and established employers pay. Examples of payment frequencies include biweekly semi-monthly.

Web This net pay calculator can be used for estimating taxes and net pay. Andrea Koegel is a plastic surgeon in Wichita KS and is affiliated with Robert J. Dole Veterans Affairs Medical Center.

See payroll calculation FAQs below. Web This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Web Use these online calculators to calculate your quarterly estimated income taxes the interest amount due on your unpaid income tax or the amount your employer should.

Kearney Levine Trends Nov2013 New Nber

Pure Mathematics 1 As A Level By Muhammad Kaleem Issuu

Homepage Excellence Gateway

Host Pay Calculator Airinc Workforce Globalization

Free 24 Employee Statement Forms In Pdf Ms Word Excel

Free Blank Pay Stub Template Payroll Template Printable Checks Templates

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Uzlj 2019 2 I Complete Pdf Pdf Standing Law Lawsuit

The Salary Calculator Hourly Wage Tax Calculator

Paycheck Calculator Take Home Pay Calculator

10 Things I Hate About Git Steve Bennett Blogs

The Salary Calculator Hourly Wage Tax Calculator

The Digital Fifth Fintech Annual Report 2022 Pdf Finance Money Management Financial Technology

Pdf Poverty Education And Employment In The Arab Bedouin Society A Comparative View Daniel Gottlieb Academia Edu

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

8 Salary Paycheck Calculator Doc Excel Pdf

Education Budgeting In Bangladesh Nepal And Sri Lanka